Wondering how to sell credit spreads profitably?

Have you tried to sell options but got frustrated at how much money or margin you need in your account?

If you want to sell put options, say on Tesla, you’ll need to be able to buy 100 shares of tesla before you can even start selling options on it. Even if you wanted to sell a covered call, you’d still need 100 shares of Tesla in your brokerage account. And at today’s price, that is about $100,000. And even if you do have $100,000 in your trading account, do you want to risk your position for just a little income on one trade?

A credit spread options strategy solves this problem.

This article covers what credit spreads are, the types of spreads, and how to sell them. I’ll provide examples and show how you can generate monthly or weekly income with credit spreads and find opportunities using an options screener. An options screener is like a search engine for options trades. I’ll give my seven rules for selling credit spreads.

What is a credit spread?

Credit spreads are a limited risk strategy that involves selling one option and buying another to generate income for the trader. It’s a fantastic way for investors to make some extra money. And they work well, even if you have a small account or want to limit the amount of capital at risk in a trade. In fact, with credit spreads, you can start trading with just a few hundred dollars. Because of this, some traders take advantage of this by selling thousands of credit spreads with different underlying securities, strike prices, and expiration dates at any one time.

A credit spread is a type of vertical spread. And there are four types of vertical spreads. 2 are debit spreads, and the other two are credit spreads. A credit spread is a strategy where you sell one option and buy another with the same underlying and expiration but at a cheaper premium.

In other words, this trade has two legs – as each option is called a leg. The option you sell is the short leg because you’re said to be shorting the option. And the other option, the one you buy, is the long leg.

The net credit is the difference in the money you get between the option you sold and the money you pay for the option you buy. And that’s where the credit spread gets its name. On the other hand, debit spreads are the opposite. You pay to enter the trade.

Call Credit Spread (Bear Call) Example

Let’s say you want to sell a call credit spread. And the stock price is $500.

And you decide to sell the $510 strike price and collect $20. Indeed, this is your short call.

Then you decide to buy the $520 strike, and you’ll pay, say, $8. And, this is your long call.

To calculate the credit, you take $20 minus $8, and you get $12. Because these are equity options, the multiplier is 100 – meaning 100 shares. So, your income on this trade is $1200. It’s money you get to keep no matter what happens. But, hey – this isn’t a free lunch. There are risks.

The Benefits Of Selling Credit Spreads

The beauty of credit spreads is that you can trade them with small accounts and limit your risks. There are two types of credit spreads. First, you have bull put spreads. However, some brokerages, like Robinhood, call it a put credit spread. Either way, they are the same.

Investors believe the stock will go up or stay above the strike by expiration with the bull put credit spread. So, it’s a bullish trade. And some brokerages call it the put credit spread: same thing, different words. The put means you’ll be trading puts.

The other type of credit spread is called the bear call. As you might have guessed, the bear means you feel the stock will move and stay below the strike price by expiration.

I prefer the original term as it is a quick reminder of the direction you want your underlying security to trade. And investors refer to this as sentiment. Bull or Bear. So, if you think the underlying is moving up, consider a bull put credit spread. And if you believe the underlying is going down, you’ll likely want to sell a bear call.

The Effects of Volatile Markets

During market volatility, your trades will be a little riskier, but investors get paid for it. Premiums are higher when there is higher implied volatility. So, traders who sell credit spreads tend to make more money when there’s volatility than when the markets are calm.

To get started selling a credit spread, in both cases, the legs of a bull put or bear call spread involves selling one option and simultaneously buying another. And with many brokerages, you can even trade the spread based on the credit amount. For instance, with interactive brokers, you can set a limit order for $1.00 credit – or $100 in premium received. You don’t have to worry about filling two individual orders.

Bull Put Credit Spread Strategy

Let’s look at a bull put spread. With a bull put spread (or put credit spread), options traders assume that the stock or the underlying security will stay above the strike price at or by expiration. In other words, with this options strategy, the trader is bullish on the stock. The premium (or the income) is what you get to keep, no matter what happens to the trade. Not only that, you’ll cap your potential losses.

Microsoft Example

Let’s take Microsoft as an example. At this moment, it’s trading at $288. With a bull put credit spread, an investor might sell a weekly $285 Microsoft put option expiring on May 13 and collect $8.75 – or $875 in premium received for the trade. I say it’s weekly because weekly Microsoft puts expire on Fridays, whereas monthly Microsoft puts expire on the 3rd Friday of each month. At the same time, the same investor can BUY the $280 Microsoft put, also with the May 6th expiry, and this one costs $7.25.

So, with this trade, the investor gets $1.50 or $150 in premium received for the trade. And this is income that they get to keep no matter what happens. Traders will want the options to expire worthless thanks to time decay. So, in this case, they’ll want the stock to remain above $285 before expiration.

If the stock moves below $285 before expiration, the trade will turn to a loss- it’ll be in the money. But, the maximum loss is the difference between the strikes minus the credit received. So, in this case, it’s $350. ($500- the $150 in income).

The only problem with this trade is that the probability of profit is just 60%. Not bad, but that also means there’s a 34% chance we’ll face a total loss – and that’s too much for me.

Remember, the maximum loss is only $350 per contract – so it’s not the end of the world. Still, if we based our decisions on “no big deal,” we’d quickly run out of money.

Decisions, Decisions

So what do we do? We could move a little further down the strikes. In this case, the $275 May 6th put on Microsoft and buying the $270 gave me a 75% chance of being profitable and a credit of $0.90 – or $90 for the trade.

Now, you might be thinking, well, $90. It’s not worth it. But, with credit spreads, small is good! With this trade, you get a 75% chance of earning $90, with the options expiring worthless in just a few short weeks. Or, you could sell the 260 and buy the 255 strikes giving you an even better chance of being profitable. Of course, the higher the chances of profitability, the lower the income you’ll receive.

And if that isn’t enough, you can always sell more than 1 of these spreads. If you sold 10, for instance, you’d bring in 10x the premium.

But here’s the thing. The further out of the money you sell the credit spread, the higher your chances to keep your money. It expires worthless, and you can move on. But, you need to find a balance. The further out of the money you go, the higher your potential loss. You’ll be collecting far less credit with the same amount of capital at risk.

Read more: What is the best strategy for selling put options?

Bear Call Credit Spread Strategy

Now, the other credit spread is called the bear call, or the call credit spread. Also, some folks like to call it the poor man’s covered call. Whatever you call it, the bear call is a bearish trade. In other words, when stocks are going down, you’ll want to sell calls. Either way, investors who sell call spreads think the stock will stay below the strike price before the expiration.

Microsoft Example

Let’s consider once again: Microsoft. It’s currently trading at $288. With a bear call, the trader will sell a call option above the current trading price and buy the same option with an even higher strike.

So, we first pick an expiration date because we want enough time to lock in our profit. In this example, I’ll consider the May 6th weekly options again (as it’s about three weeks out). I’ll sell the $290 call options strike, and buy the $295. And the net credit, in this case, would be $2.05 – or $205.

As long as Microsoft stays below $290 on or before expiration, the trader keeps all the premiums. And like the bull put, the risk is the difference between the strike prices, minus any premium: $295 ($500-$205).

Of course, the chances of getting a profit out of this trade aren’t impressive. It’s just 53%. So, you could look a little further out of the money for a better chance of profit.

We could try the Microsoft $320 call option strike and buy the $325. And the net credit in this case, at this moment, would be $0.21 or $21.

As long as Microsoft stays below $320 on or before expiration, the trader keeps all the premiums. And like the bull put, the risk is the difference between the strikes, minus any premium, so in this case, it’s $479 ($500-$21). You might say $21 to risk $500 is not worth it. But, the chances of a maximum loss is just 9%. So, you’ll need to find a balance that works for you.

Of course, this was just one example I found on a specific moment. While your results will vary, there are always opportunities to be found!

The Risks In Selling Credit Spreads

With credit spreads, the risk gets defined at the time of the trade. In fact, with a credit spread, the risk is the distance between the two strike prices, minus any premiums received, times 100.

The difference would be a near-absolute worst-case scenario. I say near absolute as there’s assignment risk in selling options. However, you can always close out the trade in the underlying should you be assigned. And, don’t forget, you already collected income. As a result, you’ll find that your brokerage will probably require the difference between the two strikes to be the margin or collateral requirement.

If you find your spread losing money, you might get assigned. If that happens, you’ll need to decide what to do.

Say you sold a call option with a $500 strike and bought the $505 strike. For example, the difference in strikes is $5. As a result, the margin requirement, or the collateral, will be $500 per contract. But here’s the thing – you collected a credit by selling this. And if the credit is say $100, or $200 per contract, that offsets any potential loss.

What Can Happen After I Enter The Trade

After you sell your spread, you’ll likely find that it goes in and out of the money. Thanks to theta, the overall value of the spread will go down if the stock doesn’t move. And this is what you want. But, if the underlying moves against you, you could find yourself with a spread facing a loss. And the closer you get to expiration, the higher the chances you’ll get assigned.

So, if you find our spread is losing money, you can repurchase it. Doing so involves selling the long leg and simultaneously buying back the short leg. Then you could sell another vertical spread with a similar credit a little further out. And this is rolling your option. Rolling is an excellent way to “kick the can” until you’re profitable. Whatever you do, always pay attention to the chances of profitability – because – you don’t want to get greedy.

The last thing you want is to get assigned. If you get assigned, it’ll probably be best to sell the stock and move on to the next opportunity.

Seven Rules To Trading Credit Spreads

When it comes to trading credit spreads,

1 – Trade options on quality companies you’d like to own.

2 – Trade options with a higher chance of profit.

3 – Target at least a 10% return on risk. For example, you’ll want a minimum $0.50 credit on a distance of $5 between the strikes. If you’re trading something far out of the money and collecting just a few pennies, you’ll probably make money 99 times out of 100. But that one time could wipe out all the profits you made thus far.

4 – Set a profit-taking order of 70 to 80% worth of the credit. Or if you can’t set that kind of order with your brokerage, say you collect $100. If you see that you can lock in $70-$80 of it, then do it and move on.

5- Attach a stop loss on your trade – if you can. Or, if find your trade is moving away from you, and the spread is now in the money, think of getting out around 50-80% of the trades maximum risk.

6- Watch the earnings dates. If you’re selling credit spreads, it’s probably better to have the expiration before any earnings come out.

7 – Use an options-friendly brokerage. Choose a brokerage that doesn’t charge high commissions, allows combination trades, and gives you access to data. I like Interactive Brokers, but it’s not the only one.

How To Find Profitable Credit Spreads

So that’s how a credit spread works. Now, how do you find credit spread opportunities? If you plan to sell a spread on one or two stocks, you can look at the chances of probability on your trade within your brokerage account’s app. But what if you want to scan 500 companies for the same opportunities? It would take forever.

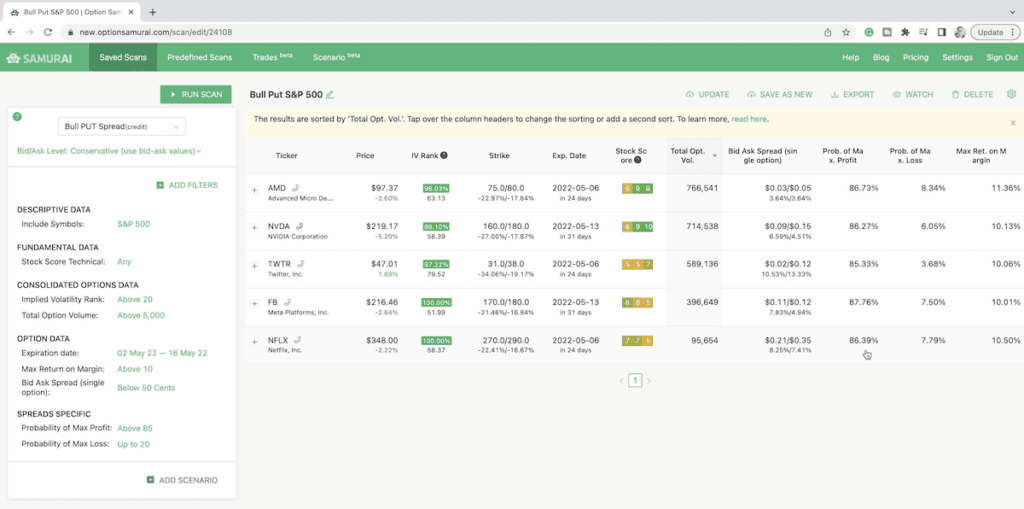

An options screener solves that problem. And for that, I like to use Options Samurai. It’s a kind of search engine of options trading – in that you can plug in what you want, and it searches the market for opportunities based on your criteria. Not only that, they give you an excel plugin, alerts, stock scenarios, and access to your trade log.

Let’s say I want to screen for bull put opportunities. I can customize the parameters that I want to search. For example, I can set implied volatility, volume, and expiration. I prefer to set it for about a month out because I don’t want anything expiring soon. And of course, there’s the most crucial piece, which is the probability of max profit and loss. Ideally, I want the probability of max profit to be 85% or more. I’m being conservative. And max loss, or otherwise a total loss, would be 20%.

The Results Are In

Then I hit “Run Scan” and got five possible trades. Let’s take a look at this one here from Meta. We can sell the $180 strike expiring May 13 and buy the $170. And your maximum profit of $1.03 per share or $103 per contract. Your maximum at-risk money is $1000, so $103 is more than 10% of that – which is what you want. And the maximum loss probability is just 7.5%. Not bad!

We can also look at Netflix. In this case, the screener suggests selling the $290 May 6th put option, and buying the $270. It will generate $2.18 at the midpoint, and the chances of maximum profit are 86%.

Of course, you can tweak the options screener to however you like, and of course, it has 24 different strategies to choose from and so many other parameters to choose from.

Final Thoughts

Selling credit spreads can be an excellent way to generate weekly or monthly income, even with conservative risk tolerance. However, it’s always best to review your investment objectives by seeking qualified investment advice from an advisor before starting any investment strategy. If you’re just starting, consider trying to paper trade before going live.

DISCLAIMER: All information and data in this article is solely for entertainment purposes. I’m not a financial advisor, nor licensed in any way to provide any financial advice. The information herein is based solely on my personal opinion and experience. All investments hold inherent risk, and the information provided on this website should not be interpreted as any kind of guidance, recommendation, offer, advice, or suggestion. Any ideas and strategies discussed on this website, or in this article should not be implemented without first considering your financial and personal circumstances or without consulting a financial professional.