There are a lot of different techniques and strategies employed in the world of crypto trading and financial markets generally. Quantitative trading is a popular trading style used in forex and stock trading.

Quantitative trading refers to strategies that use quantitative analysis indicators such as price, volume, price-earnings ratio (P/E), and other inputs to identify the best trading opportunities.

In today’s article, we’ll cover what quantitative trading involves, how it differs from algorithmic trading, its benefits and drawbacks, and how you can become a quant trader.

What Is Quantitative Trading?

Quantitative trading is a software-based trading strategy that uses mathematical models and calculations to assess patterns and trends in the movement and behavior of crypto prices and pick undervalued coins at the right time for a profitable trade.

It’s popular among financial institutions, hedge funds, and high-frequency trading firms that handle large transactions involving purchasing and selling hundreds of thousands of shares and other securities.

Individual traders can also participate in quantitative trading by either building (if you have computer programming knowledge) or purchasing customizable algorithmic trading software.

The main goal is to use a trading bot to identify under-valued cryptocurrencies while eliminating human intervention from investment decision-making. Data inputs for quantitative models include historic price, volume, and correlation. The bigger the dataset used, the better.

Cryptocurrencies have cyclical patterns; quantitative trading techniques can help cash in on those trends. Traders can customize quantitative trading algorithms depending on the trader’s preferences and evaluate different parameters related to a cryptocurrency.

What is a Quant Trader?

The most basic definition of a quant trader is using numbers and data to make trading decisions. However, this doesn’t get us very far since all traders use numbers and data. More specifically, a quant trader employs mathematical models involving statistics and analytics to pinpoint profitable trading opportunities. In this way, quant traders combine advanced skills in mathematics with high-level proficiency in coding and knowledge of financial markets.

A quant trader is someone with an interest in the future. While algo traders focus on backtesting using historical data, quant traders extensively use statistics, mathematical models, and substantial data structures to predict future market transactions.

How Does Quantitative Trading Work?

Professional quantitative traders or “quants” use different quantitative analysis indicators such as price movement, trade volume, and historical market data to craft profitable models for trading assets.

They feed that data into algorithmic trading software, and then the program is backtested and optimized in a virtual setting. The system is run in real-time markets using real money if favorable results are achieved.

You don’t need a mathematics or computer programming degree to try quant trading. Individual traders can access trading software similar to what professional quants use in two ways: build or buy.

Building requires a solid knowledge of computer programming to develop a working automated trading system. Less tech-savvy traders can buy or rent ready-made trading software. Many platforms offer trading software specifically designed for the crypto market. Crypto traders can use these services to purchase trading bots tailored to their quant strategy.

Don’t know any quant strategies? That’s OK! There are resources for finding quant strategies made by experts. Quantpedia is an example of one such resource. It’s an encyclopedia for quant trading methods that work.

Examples of Quantitative Trading

Quant traders can employ several trading approaches, but we’ll take a brief look at two in particular—high-frequency trading and momentum trading. In the fast-paced world of finance and crypto, speed counts.

In high-frequency trading, quantitative traders execute ultra-fast transactions by using complex algorithms. Given the complexity, speed, volume, and costs, only quant traders at large financial firms will do.

On the other hand, non-institutional quant traders can use momentum trading, which can be incredibly profitable over a shorter period. For example, quant traders engaged in momentum trading crypto can also leverage the market’s notorious volatility for increased profits.

Quant traders identify momentum by using a range of technical indicators, which can include a stochastic oscillator, relative strength index (RSI), moving average (MA), and moving average convergence/divergence (MACD).

In high-frequency and momentum trading, quant traders have been drawn increasingly to the crypto market precisely because its volatility offers the perfect conditions to predict how top cryptocurrencies will perform.

Is Quantitative Trading Profitable?

Yes! Quantitative trading can be profitable if you first test and validate your algorithm. Unfortunately, traders often don’t set up bots properly, or if they do, the market changes in ways they didn’t anticipate, and they end up losing money. This can make it seem like quant trading doesn’t work, but the reality is that the trader is likely using a poorly optimized bot.

What Is the Difference Between Quantitative Trading and Algorithmic Trading?

Quantitative trading is similar to algorithmic trading in that both algo and quant traders use algorithms to automate the trading process. But there are a few noticeable differences.

Quant trading involves mathematical models to speculate on market behavior, while algo trading involves computer algorithms to automate trading decisions and executions.

Both trading styles use bots and data from technical, fundamental, or quantitative analysis. The bots can focus on price, timing, or quantity when making trade decisions.

How Hard is Quantitative Trading?

Quantitative trading may sound complicated, but breaking it down is just using a computer program to automate buying and selling crypto assets when certain conditions are met. For example, you can buy and sell cryptocurrency and then set up a program that automates that function.

You can build your algo trading software if you have programming skills. You can use platforms that sell ready-made trading software if you’re not a programmer. Many of these platforms offer their trading software for free with limited functionality or with limited trial periods of full functionality.

Advantages and Disadvantages of Quantitative Trading

Pros

- Eliminates emotions: Quantitative trading eliminates subjective judgment by using cold, hard data to make trading decisions. It helps prevent the irrational investment decisions that often occur in volatile markets.

- Less prone to error: Trading bots work precisely as coded. As long as you’ve input the correct data, you can be sure the bot will follow your instructions to the letter.

- Faster execution: A bot will consistently execute trades faster than a human. It doesn’t need to eat or sleep; you can have it up and running 24/7 while you do other things. It guarantees quick execution, which is valuable in a volatile market.

- Suitable for larger portfolios: Large financial institutions and hedge funds leverage quantitative trading because it’s a great way to manage large investment portfolios. If your portfolio comprises dozens of different assets in various markets, then quant trading is a great way to manage your investments.

Cons

- Limited use: The data used for quantitative trading loses its effectiveness if it becomes public knowledge or if market conditions suddenly change, a common occurrence in the crypto world.

- Requires regular maintenance: Regardless of the market you’re trading in, your bot requires regular maintenance to ensure it’s on the correct course and to prevent slippage. Minor fluctuations can end up leading to big losses if left unchecked.

Best Quantitative Trading Strategies

Popular quantitative trading strategies include:

- Arbitrage: Arbitrage trading in crypto involves simultaneously buying and selling a cryptocurrency to generate profit. Arbitrage opportunities occur when there is a significant price gap in different exchanges, enabling you to buy low in one exchange and immediately sell high in another exchange.

- Trend trading: This approach involves placing a buy or sell order based on a cryptocurrency’s price trends. Traders look at market charts for trend lines and analyze a cryptocurrency’s support and resistance levels to identify the best time to open and close positions.

- Hedging: This is a set of strategies that involve simultaneously placing two orders in opposing positions so that a gain or a loss in one position cancels out the changes in the value of the other position.

How Much Do Quant Traders Make?

If you’d like a professional career as a quant trader, your skills will command a premium from financial companies.

In 2024, the average salary for a quantitative trader is $316,764, with some of the highest annual salaries topping out at $500,000+. You’ll also get a yearly bonus in the neighborhood of $125,000 on top of your salary, and geography can also impact your earnings. Salaries are higher in places like New York or other major cities, but the living costs are also higher.

However, if you’re strictly an algorithmic trading quant, you can expect to earn $145,000 yearly.

How to Start Quantitative Trading

Quantitative trading is all about developing a system for identifying profitable trading opportunities. If you want to start quant trading, consider the following:

Time frame

Choose a time frame and trade frequency you can realistically monitor. While a trading bot can run independently, human oversight is still necessary. No bot can produce profitable results forever. You’ll need to step in and alter the algorithm occasionally.

Financial constraints

Factor the commissions charged by trading platforms into your starting capital. Brokers charge commissions that can rack up quite fast, especially if using a high-frequency trading strategy. Find low-cost brokers who charge commissions that won’t affect your profit potential.

Strategy

Developing and fine-tuning a strategy is a core part of successful quantitative trading. If you already have a strategy you use when you trade manually, can you adapt it into an algorithm? Trading strategies with specific rules such as entries, stop losses, and price targets are generally easiest to input into a bot. Alternatively, you can copy tried and tested strategies created by other traders using resources like Quantpedia.

Backtesting

The most crucial step is backtesting the trading bot on historical data. The testing process involves letting the bot run in a demo setting using data gathered from quantitative analysis indicators. You can run the bot through thousands of trades to assess the performance of your quant strategy and determine if it’s profitable and within an acceptable margin of your risk tolerance.

Execution

The next step is to run your algorithm through the real market and verify that it works in live conditions. Many exchanges have a public API that can be used to securely connect the bot to your exchange account and automate trades.

Risk management

Trading software requires regular attention. You must monitor its performance and track market conditions to ensure it’s working as expected. Some adjustments may be required to keep up with market changes.

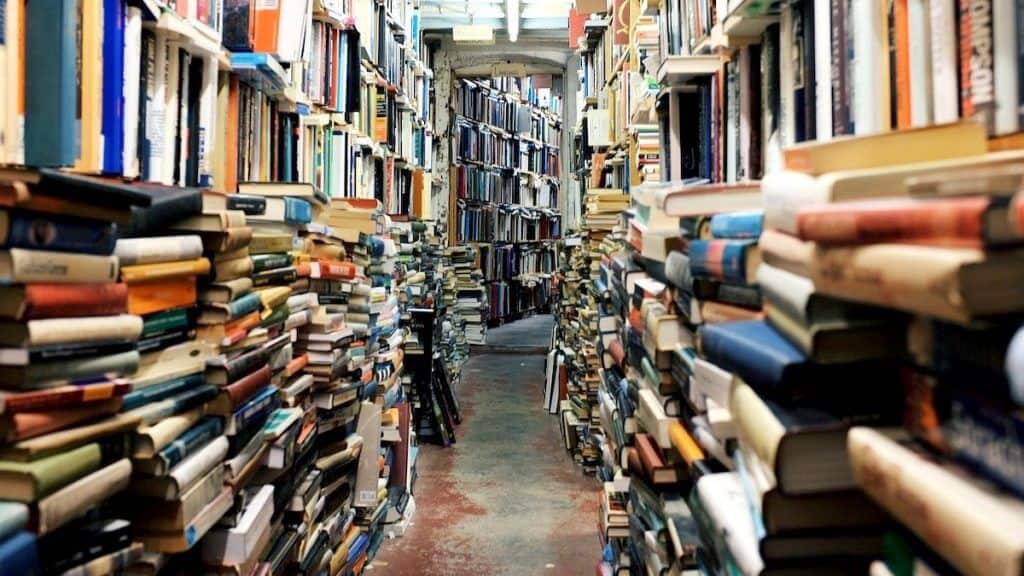

The Best Quantitative Trading Books for Beginners

Quant trading might seem intimidating for beginners, but there are plenty of books to get you started quickly and relatively easily in this exciting investing field. Here are three great options.

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (2008) by Ernie Chan offers a nice look at quantitative trading and how to scale your trading strategy based on its profitability under different market conditions. Chan even has a helpful section on risk management.

Finding Alphas: A Quantitative Approach to Building Trading Strategies (2020) is a collection of essays offering a practical guide for designing and implementing successful, quant-based trading systems. An excellent read for beginners looking to gain some insights from professional quants.

Inside the Black Box: A Simple Guide to Quantitative and High-Frequency Trading (2013) by Rishi K. Narang is a best-selling book, and for a good reason! Narang looks at what quant traders do clearly and comprehensively, which is easy for beginners to understand. And don’t miss the section on high-frequency trading.

The Encyclopedia of Trading Strategies (2000) deserves a spot on every trader’s shelf. Experienced traders themselves, the authors focus on proven, market-beating strategies that have yielded solid returns. Their writing might be a bit heavier on the nuts and bolts of trading. Still, the patient reader is rewarded with a wealth of trading insights and information, making this an indispensable reference work for aspiring quant traders.

Conclusion

In financial markets, quantitative trading is favored by financial institutions with the resources to run their proprietary trading software with dedicated support staff and data centers.

However, you don’t need to be a big hedge fund to dabble in quant trading and put on the shoes of a quantitative trader. Individual crypto traders can also try their hand at it by building algorithmic trading software or buying ready-made trading software.

Be aware of the time, financial, and market constraints of using bots for trading. Just because quant trading uses bots doesn’t mean it’s something you can set up and forget about.

Quant trading can be a profitable investment strategy, especially if you know how to analyze data and work with a large crypto portfolio. It’s a great way to manage your portfolio while eliminating emotions and human error.