While many traders use options as a direct trading instrument to leverage stock returns, they can effectively hedge and manage the risks of a trader’s equity portfolio, supplementing their investment strategy. This means that when an investor uses the right tools at the right time, they can effectively limit their portfolio losses. This informational article outlines the primary strategies for using options to hedge stock portfolios.

Important Terminologies

Options come with different jargon from stock market trading and futures contracts trading. These are the core terminology investors need to understand before they attempt to trade.

Options are sold as a contract and contain many underlying assets such as equities (your favorite stock), forex, cryptocurrencies, commodities (think chocolate, yum!), and more.

For this article, we’ll discuss equity options as they are tied to 100 shares of the underlying asset – per contract. So, 2 contracts on AAPL means 200 shares of AAPL. Once done, we’ll move on to how hedging helps with your earnings.

Call Options

A call option is a contract that gives the buyer (or holder) the right but not the obligation to purchase an asset at a certain price within a certain period. The buyer pays a premium to secure this right. Long calls are bullish because the holder profits if the underlying asset’s price increases above the strike price.

Put Options

A put option is a contract that gives the buyer (or holder) the right but not the obligation to sell an asset at a certain price within a certain period. Like a call option, the buyer pays a premium for this right. Long puts are usually considered bearish because the owner profits if the underlying asset’s price drops.

Long or Short, Buyer or Seller

The buyer of an option is said to be “long” and is also the one holding the contract (the holder).

The buyer (also known as the holder or contract owner) is the person “going long” on the option. They are the ones purchasing the option and the ones paying the premium. They will receive (call) or sell (put) the assets if they choose to exercise the option before expiration.

On the other hand, the seller or the person writing the contract sells the option, and in return, they are the ones receiving the premium. When someone sells an option, they are said to be short. A short options position means the seller will provide (call) or purchase (put) the assets if the buyer exercises the option before expiration.

We will use these terms interchangeably throughout this article.

Strike Price

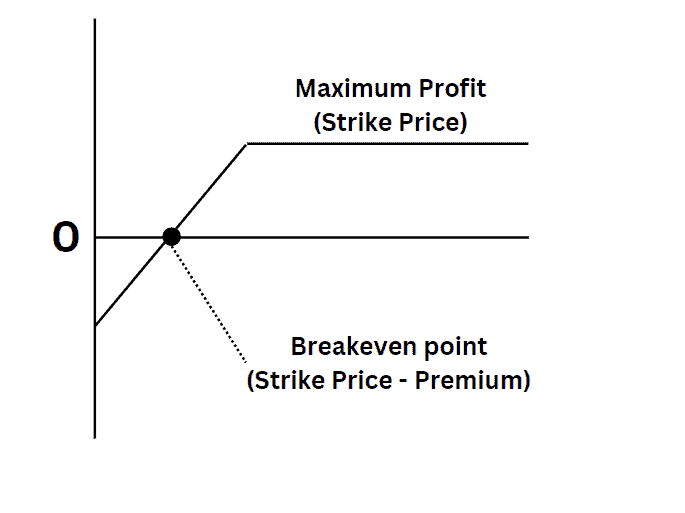

The option strike price is the pre-specified price wherein the underlying asset will be purchased/sold if the holder exercises the option. For call option contracts, the underlying asset’s current market price must move above the strike price for the holder to profit. On the other hand, put options are profitable when the underlying asset price is lower than the strike price at expiration.

Premium

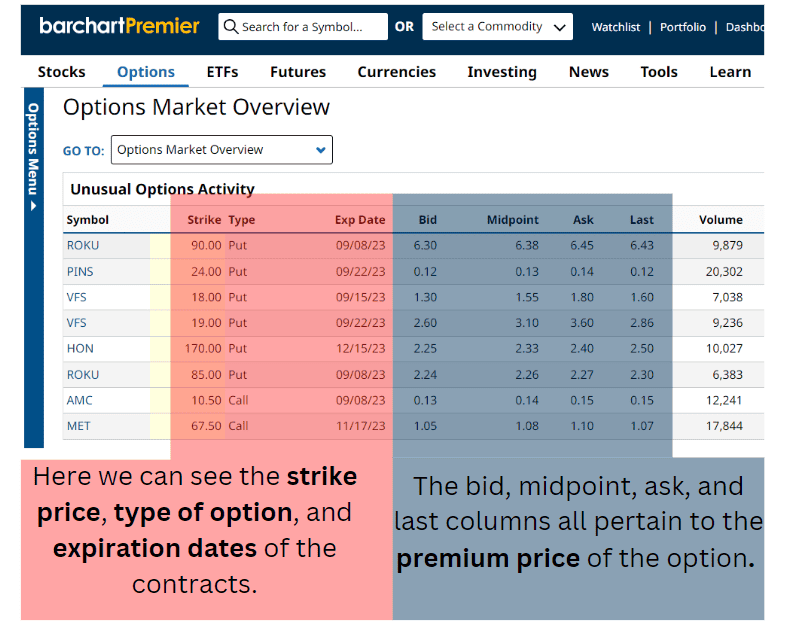

Premiums are the amount the holder (buyer) pays the writer (seller) to secure the contract. Premium prices are dictated by factors like implied volatility, moneyness, and the time to expiration.

Exercising an Option

Aside from calls and puts, there are two types of options for investors to trade: American options and European-style options; the difference lies in when the option holder can exercise the option. It’s important to understand the difference between the two.

With American options, the holder can exercise their right to purchase or sell underlying assets at the agreed-upon strike price any time before expiration.

On the other hand, with European-style options, the buyer can only assign on the expiration date.

Naturally, whether you’re holding American or European-style options, exercising the option is only worthwhile if the option is (ITM) or in-the-money.

Expiration

The expiration or expiry date marks the end of the contract. Traditionally, options expire on the 3rd Friday of every month; however, today, many options expire daily, weekly, monthly, weekly, bi-yearly, and yearly. And some options, known as LEAPS, expire years into the future.

Once expiration comes around, the holder can exercise their right and get the stock at the strike price if it is in the money (higher than the strike price in call options, lower than the strike price for put options). In this case, they must have enough money in their trading account to cover the purchase of the underlying asset.

The holder can also let it expire worthless if the asset price is not above or below the strike price, depending on the option type. This is called being out of the money (OTM). The holder loses nothing besides the premium paid and any transaction costs should they not choose to exercise their right.

Options Data Sources

However, before implementing any strategy, the potential outcomes should be backtested using a historical data source and a derivatives valuation tool. It’s also important to have a source for your current stock and options data, along with a tool to find options trades with high possibilities of profit. Using tools like this will enable traders to maximize profits while limiting losses – which is exactly what hedging aims to accomplish.

Most Common Hedging Trading Strategies

In this section, we’ll review different options trading strategies investors can use to both generate income and limit portfolio losses. This is by no means an exhaustive list. However, it contains the most common strategies out there. It also bears stating that this article is to inform people on how to trade options and is not supposed to be taken as investment advice.

Protective Put

Also known as a “married put,” this is the most straightforward and easy-to-implement strategy. Protective puts involve buying options on stocks the investor already owns, intending to protect the long position. If the stock prices drop, the gains from the put options can offset the losses in the underlying stocks. A protective put is best employed when the investor is bullish in the long term but wants to protect themselves from sudden short-term losses.

For example, let’s say an investor purchases 100 shares of Company T, and they currently trade for $50 per share. The investor is concerned about recent market noise and wants to limit potential losses; similarly, the investor is bullish on the stock and expects the price to increase. But hope can only take them so far. To hedge their position, the investor purchases one put contract (from someone selling put options) at a $2 premium with a strike price of $45 — $5 less than the investor paid. The expiration is set for 1 month from today.

Fast forward 1 month: Scenario 1

Let’s say Company T’s stock price crashes to $40 before the option expires. Should the investor decide to sell at this point, this will amount to a $1,000 loss from where the stock was one month ago

This is where a protective put helps. Since the investor holds a put option, they can exercise the option and sell Company T’s stock for $45, even if the current price is $40.

The results are then calculated as follows:

($50 asset price + $2 premium) – $45 strike price = -$7 (loss).

However, if the investor did not buy the put option in the first place, they would have incurred a $10/share loss.

As a result, the put option hedged the position and limited their loss by 30%.

Scenario 2

But if, by expiration, the asset price trade stays above the strike price, the option expires worthless. That said, the investor can keep the underlying asset while it rises in price. Protective puts can be purchased at-the-money (ATM) or out-of-the-money (OTM). An at-the-money put protects the asset’s value, limiting the investor from any loss below the strike price and premium paid. Protective puts reduce the risk of capital loss in case prices drop significantly within the contract period.

Covered Call

The covered call strategy is slightly different from the protective put in that it does not create an offsetting option position. Rather, it provides an income stream that can supplement the portfolio gains and reduce future potential losses. The covered call strategy involves selling call options and hedging against an existing position. If the stock price remains below the strike price, the investor keeps the premium from selling the call options. If the stock prices rise, the potential gains are limited.

Essentially, the trader is forgoing some of the potential future upside of the stock in return for an upfront fee.

To illustrate, an investor purchases 100 shares of Company T for $50 and writes a call option with a $60 strike price and a $1 premium. The seller is given $1 per share if a buyer purchases the option.

Company T’s stock bounces between $50 and $55 within the contract period. If the asset price stays below the strike price, the call option will be out-of-the-money (OTM)The buyer will not exercise the option in this case.

The call option seller (writer) then keeps the $1 premium and the original assets and can write another call option. As long as the buyer does not exercise the option, the seller/writer’s stock will not be assigned, and they can continue to sell a call option and receive premium payments.

However, if the asset’s price rises above the strike price, say $65, the buyer will exercise their option. The writer will then sell the stocks for $60, capping their profit to $10 (remember, they purchased it for $50) instead of $15, plus whatever premium payments they received for the contract.

How to Find Profitable Covered Calls

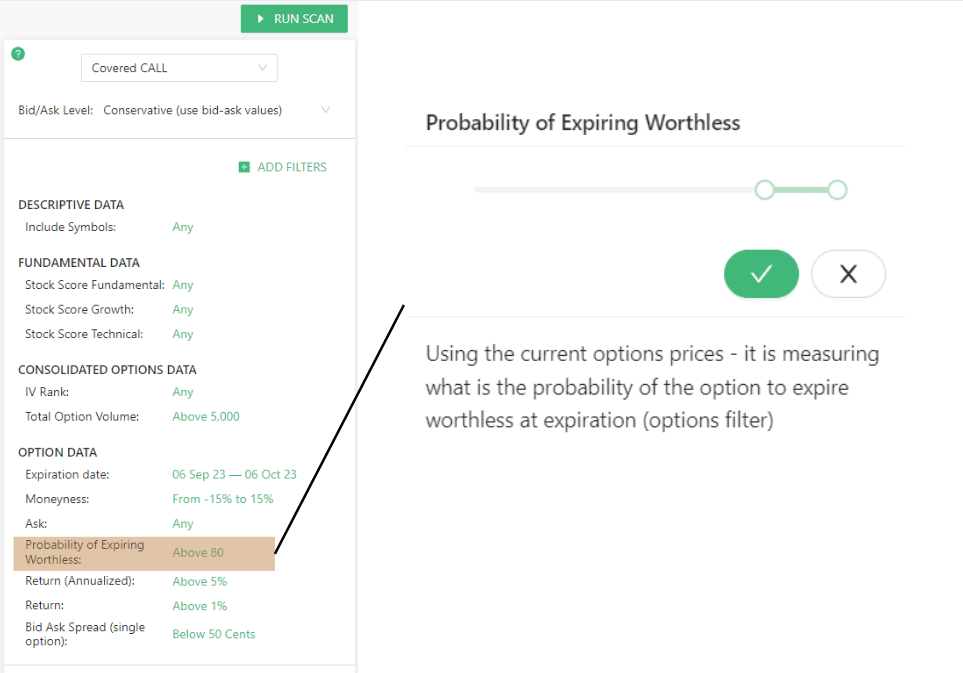

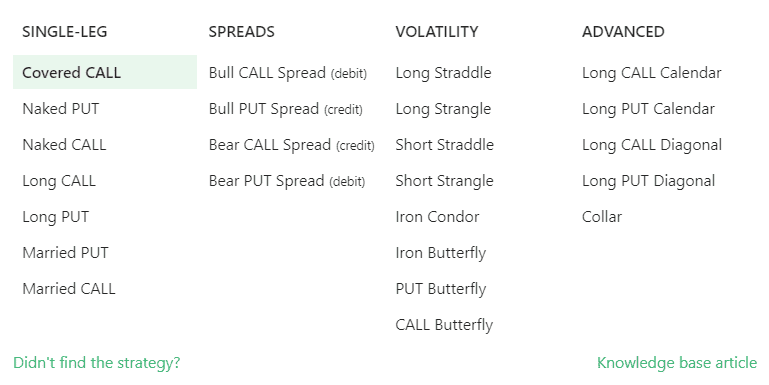

Websites like Option Samurai allow traders to scan the options market for ideal contracts for covered calls. It uses a variety of filters to customize the scans, like implied volatility, options volume, expiration date, etc. One such filter is the Probability of Expiring Worthless, which users can manually set between 0 to 100%.

The probability of expiring worthless is a crucial metric since the covered call strategy relies on receiving premium payments for assets the trader wants to keep for a long time. For the option seller, the higher the probability the option expires worthless, the better.

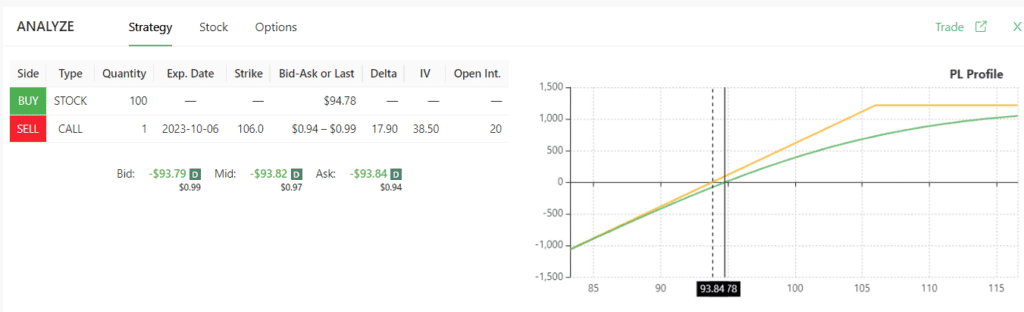

Aside from that, the options scanner provides users with a step-by-step strategy, including entry prices for assets, strike prices, potential profits, and more. Selecting any security appearing in scans will show the suggested strategy at the bottom of the screen.

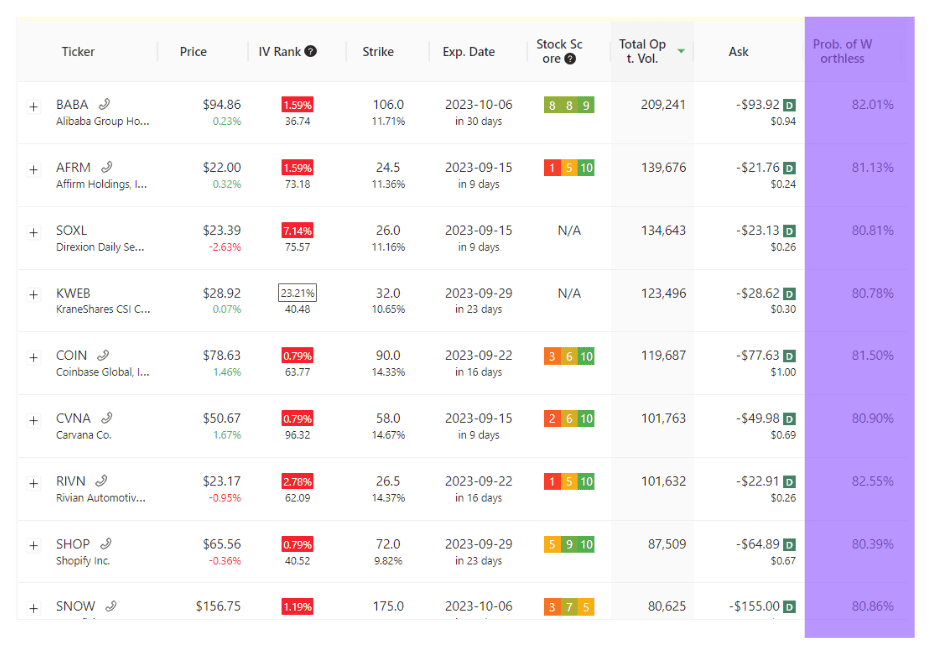

Using BABA as an example, we can see that Option Samurai is suggesting that the trader buy the stock for $94.78, then set up a covered call with a $106 strike price and a premium range between $0.94 – $0.99, which will expire on October 6, 2023. For reference, this scan and strategy were generated on September 7. This means that, after a month, the trader has an 82.01% chance to earn a $94 to $99 profit from the suggested covered call.

That said, options scanners aren’t limited to covered calls. They offer scans for different options strategies which traders can choose from, depending on their risk tolerance, market outlook, and knowledge.

Collar Strategy Hedging

The collar strategy combines a protective put with a covered call. The trader sells a call option on a stock and uses the premium from the option sold to purchase a put option. The combined position results in the trader limiting his/her upside while protecting from the downside. A collar’s major benefit is its low (or zero) cost-hedging strategy.

Let’s take the previous example with Company T. Same as usual, the trader purchases a stock position of 100 shares for $50.

First, the trader writes (sells) a call option for the Company T stocks with a strike price of $60 and a premium of $2. The trader will receive $2 per share for the contract.

At the same time, the trader will buy a put option with a $45 strike price, paying a $1.50 premium for the contract.

So here’s the rundown of the scenario for this collar setup:

- The trader now receives a $2 premium in the covered call.

- The trader paid a $1.50 premium for the protective put leaving $0.50 as a credit ($2 – $1.50). The trader is using the call to pay for the put.

- If the stock price rises above the $60 strike price, the covered call seller will be assigned and will sell their stocks for $60. At the same time, the seller earns a $10 profit per share, and they get to keep their $2 premium for the call option.

- If the price drops below the $45 strike price, the trader can exercise the put option and sell the stock for the strike price, limiting the risk of loss to $5 per share.

- Collars can take advantage of wide price fluctuations. Like a covered call, collars limit the potential profit with the added bonus of limiting (or eliminating) downside risk. The trader can continue writing calls and buying puts to protect their assets if the price remains stable.

- The trader might choose to adjust the strike prices and the range of values if the underlying asset’s specific price moves in the trader’s favor. For example, if the asset’s price moves to $59 or $60 at expiration and the holder does not exercise the call (which they most likely wouldn’t, but, again, the holder can exercise any option, at any time, for any reason within the contract period, even if it doesn’t make sense), the trader may want to write the next call with a $65 strike price and buy a $55 put option. This way, the possible profit from any significant upward move is raised from $10 to $15. Meanwhile, the potential $5 loss becomes a $5 profit if prices deteriorate.

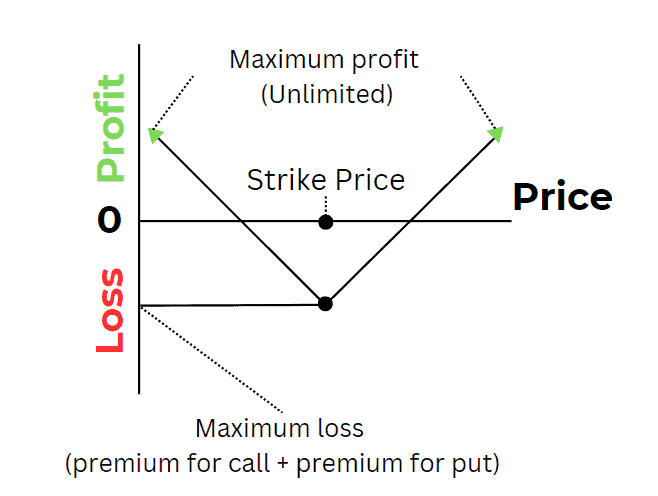

Hedging With a Long Straddle or Strangle

Straddles and strangles involve buying both calls and put options with the same expiration date and strike price (straddle) or different strike prices (strangle). They are used when significant price volatility is anticipated, as they can profit from substantial price swings. Further, unlike a married/protective put or covered call, the investor does not need to own the underlying asset to engage in the trade.

Here’s how it works. Let’s say Company T is trading at $50 and about to release their quarterly report. If a trader anticipates that the stock will experience a big price movement in either direction, they can buy an ATM call option and a put option with the same $50 strike price and the same expiration for $2 each (meaning $4 per share total).

In short, the trader is profitable if the stock moves at least $4 in either direction, which is the initial cost of the strategy.

If the stock price moves to $60 at expiration, the option will be in-the-money by $10. The option premium will be higher (likely much closer to $10). So, the trader can either lock in the profit and sell the call option or exercise it. To the call option holder, exercising the option means buying the stock at $50 and selling it for $60. This will earn them $10 per share less $4 for the premium, giving them a $6 net profit before taxes and fees – times 100 per contract, of course

Conversely, if the stock price drops to $40 at expiration, the put option will be in-the-money. At that point, the trader can either sell the option at a $10 profit or exercise the put option by buying the stock at $40 (from the put option seller), selling the stock at $50 (market price), and earning $10 per share from the price difference When calculating profit and loss, don’t forget to account for the $4 for the premium, which in this case will result in a $6 net profit per share. This is an example of a long straddle. A long strangle has a similar result but uses two different strike prices for the call and put.

Traders and investors concerned about significant volatility going into an earnings season may use a long straddle or strangle position to insulate the portfolio from market movements. A significant issue with these strategies (especially the straddle) is the high cost of purchasing two options to hedge the portfolio. Since the breakeven price is high, price movements must be big enough to cover the premium payments for the two options.

Put Ratio Backspread Hedging Strategy

The put ratio backspread hedging strategy involves multiple steps, starting with selling one or more put options and using the premium to buy more put options at a lower strike price. It’s used when an investor anticipates a significant downside market move and wants to protect their portfolio while potentially profiting from a sharp decline.

Let’s take Company T again, with its $50 current price.

If a trader is bearish on the stock and expects a soft fall in price but not completely ruling out a steep decline, they can write/sell one put option with a $50 strike price for a $2 premium with a one-month expiration.

At the same time, they can purchase two put options for a $47 strike and pay a $0.75 premium for each. With this strategy, the trader pays $1.50 for the two put options they bought. Meanwhile, they received $2 for the written option, netting them $0.50 a share ($2 – $1.50 = $0.50) for the trade. This completely offsets the cost of the put options they bought.

Fast forward to expiration, and Company T now trades for $43.

Both put options will be exercised. This means the option seller must buy the stock for $50 a share, resulting in a loss of $7 per share.

But, since the investor also holds 2 put options at a $47 strike, those are in the money. Indeed, the investor can exercise the two put options they bought, grossing $4 per share ($47- $43). The P&L, after adjusting for premiums, looks like this:

Asset Value At Expiration: $43

Short Put Option @ $50 strike – $43 = $7 x 100 = -$700 (Loss)

Premium Received: $2.00 x 100 (1 Contract) = $200 (Profit)

Long Put Option: @ $47 strike – $43 = $4 x 200 shares (2 contracts) = $800 (Profit)

Premium Paid: $0.75 x 200 (2 Contracts) = -$150 (Loss)

Grand total: $150 (Profit)

With this hedging strategy, the investor received a $1.50 profit per share (or $150/contract), mitigating a potential $7.00 loss.

Conclusion

Familiarizing yourself with the basics of options hedging is an excellent first step into the options market, which can further improve your stock portfolio performance. Many more strategies can be used for options trading, like long call diagonal spreads, butterflies, synthetic calls and puts, etc. These strategies offer versatility, allowing traders to earn by hedging their stock portfolio in any market condition. However, remember that any financial instrument carries risks, so assess your investment objectives and levels of risk before jumping into options hedging strategies.