The market has continued to shift towards a greener and more sustainable future due to growing concerns about climate change. As a result, the electric vehicle (EV) market is gaining significant interest. Even the government has incentivized consumers to transition to EVs through tax credits, leading to a boom in other industries like lithium companies. With most new technology utilizing lithium for batteries, demand for these products is anticipated to increase dramatically. This opens up opportunities for investors to ride through a booming market backed by government legislation, limited mineral supply, and surging demand.

The lithium play

As the market slowly transitions to full EV, let’s look at how Lithium companies can provide great investment opportunities for investors as a proxy to the EV market boom.

EV revolution and lithium demand

The shift towards electric vehicles represents a fundamental change in the transportation sector. With EVs relying on lithium-ion batteries for energy storage, lithium has become a critical resource in the automotive industry’s evolution. Due to its superior energy density, longer lifespan, and faster charging capabilities compared to other options, the demand for lithium has surged astronomically.

Accelerating EV adoption

EVs are gaining popularity, and governments support the change through policies to incentivize EV adoption. This has led to a surge in demand for lithium. More and more automakers are also investing heavily in EV research and development alongside others that have committed to transitioning their entire fleets to electric vehicles in the coming years can translate to sustained demands for lithium.

Growing Supply-Demand Imbalance and limited supply

As demand for lithium continues to soar, the global supply of this resource has struggled to keep pace. With lithium productions concentrated in a handful of countries, increasing demand has put pressure on existing lithium extraction and processing capabilities, leading to supply constraints that have resulted in rising lithium prices

Lithium’s Role Beyond Electric Vehicles

While the rise of EVs has been the significant driver of lithium demand, investors should also remember that lithium has applications beyond the automotive industry. As markets continue to look for greener options, lithium-ion batteries’ superior quality makes them a preferred option by most renewable energy storage systems. Transitioning to clean energy sources like wind and solar power necessitates efficient energy storage, making lithium-ion batteries a vital component for green-energy alternatives.

Now let’s look at two buy-rated companies in the lithium industry.

Piedmont Lithium Inc ADR (PLL)

Piedmont Lithium, Inc. is an Australian multi-asset integrated lithium business that supplies lithium hydroxide to battery manufacturing supply chains and electric vehicle companies in North America. The company has two lithium projects in the United States:

- Carolina Lithium

- Tennessee Lithium

Tennessee Lithium is the company’s proposed merchant lithium hydroxide manufacturing plant in McMinn County, Tennessee, while Carolina Lithium is its proposed, fully integrated spodumene concentrate-to-lithium hydroxide project located in Gaston County, North Carolina. The company’s project portfolio also includes strategic investments in lithium assets in Ghana, West Africa, and Quebec, Canada. Carolina Lithium is located within a resource in the Carolina Tin-Spodumene Belt. It is being designed as the company’s fully integrated project with spodumene concentrate production, mining, and lithium hydroxide manufacturing on a single site in Gaston County, North Carolina.

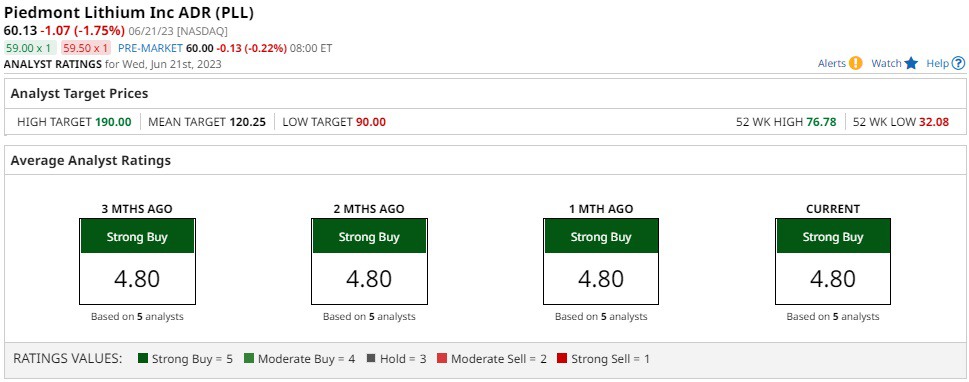

Analyst Rating

Analysts rate PLL as a “Strong buy” based on four strong buy and one moderate buy analyst recommendation. The mean target for PLL is set to $120.25 and a high target of $190, translating to a potential upside of 216%.

Livent Corp (LTHM)

Livent Corporation is a fully integrated lithium company that manufactures lithium intended for use on a range of lithium products like lithium-based batteries, chemical synthesis applications, and specialty polymers. The company is focused on supplying high-performance lithium compounds to electric vehicles (EV) manufacturers and broader battery markets. The company also supplies butyllithium, which is used in producing polymers and pharmaceutical products alongside a range of specialty lithium compounds. This includes high-purity lithium metal for non-rechargeable batteries and for producing lightweight materials for aerospace applications. The company’s product category includes:

- Lithium Hydroxide

- Butyllithium

- High Purity Lithium Metal

- Lithium Carbonate

- Lithium Chloride

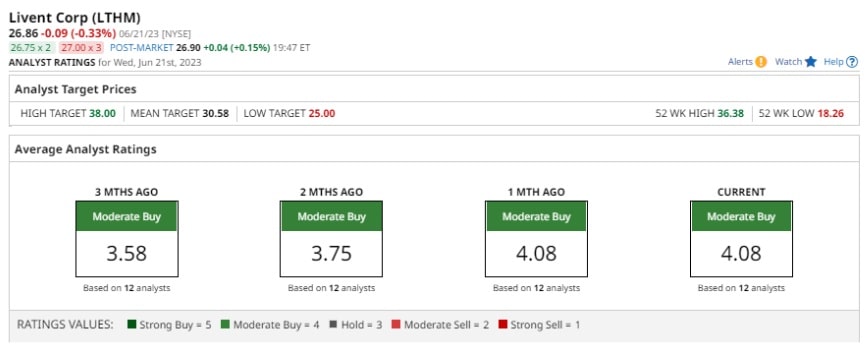

Analyst Rating

Analysts rate LTHM as a “Moderate Buy” based on six strong buys, one moderate buy, and five holds from analyst recommendations. The mean target is set to $30.58 and a high target of $38.00, an upside of 41.47%

Final Thoughts

The rise of electric vehicles and green energy solutions has ushered in a new era of transportation and battery storage demand. This ignited a surge in lithium prices and demand due to it being a primary component in lithium-ion batteries. As the global transition to clean energy gains momentum, lithium’s importance will continue to grow and extend its applications beyond electric vehicles. However, even with the industry’s bright prospects, an investor should still conduct their due diligence to ensure that these companies match their risk appetite and meet their investment goals.