Technology has had a significant impact on our lives and the way we do business. Banks provide convenient banking services through digital channels. It has enabled us to transact with our clients and customers more efficiently. However, it has also opened up avenues for fraud and other forms of cybercrime.

Using the right technology and tools, we must protect ourselves from these new risks. We should use Know Your Customer (KYC) services that provide digital IDs for verification.

What is KYC Technology, and How Does it Work?

KYC technology is a set of tools that helps businesses identify and verify their customers.

Banks can use KYC technology to verify the identity of their customers. It also has many other applications, such as confirming an individual’s identity in an online transaction or determining if they are eligible for a loan or mortgage.

KYC technology has been around for many years and is not going anywhere soon. It will continue to develop as fraudsters find new ways to outsmart it.

Best Ways You Can Use Technology in Your Business

KYC technology is a must-have for businesses involved in any online transaction. The KYC process can be done in various ways, depending on what kind of business you are running. If you have an e-commerce store and sell products online, you need to use Know Your Customer technology to verify the identity of your customers before they make a purchase. If you sell products offline, the best way to go about this is by using mobile phone transactions.

Let’s talk about what some of the KYC options are.

- KYC Registries are databases that store the information of individuals and organizations. Financial institutions, law enforcement agencies, and corporations use them to verify the identities of their customers.

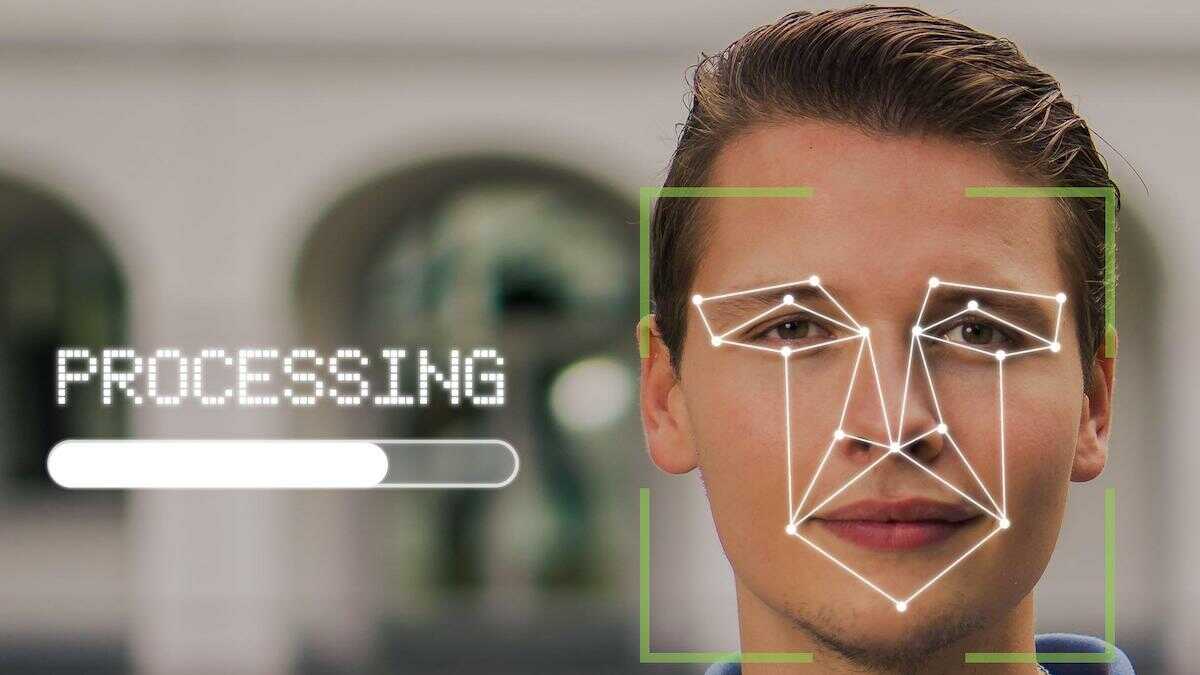

- Electronic KYC verification (eKYC) uses biometric identification methods such as fingerprint scanning or facial recognition to identify your customer in a matter of seconds.

- Mobile KYC uses your smartphone camera to capture your ID document and instantly transmits it to the business you are trying to access. The company can then use this information to verify your identity securely, which does not require you to hand over sensitive personal data.

- Biometrics authentication uses an individual’s measurable physical and behavioral characteristics for identification and authentication. Biometric technology can identify individuals based on fingerprints, DNA, face, voice, retina, or iris scans.

- Voice Recognition is a technology that allows you to identify and authenticate a person through their voice. It’s not as accurate as fingerprint scanning, but it’s still beneficial in many situations.

- Knowledge-Based Authentication (KBA) is a type of authentication method in which the user has to provide some “knowledge” to authenticate themselves and access a system. This knowledge can be anything from a personal identification number (PIN) to a secret question or even something like your mother’s maiden name. The idea behind this type of authentication is that it doesn’t matter how many times somebody guesses your password if they don’t know your mother’s maiden name.

- SMS-Based Two-Factor Authentication technology is one of the most popular ways to verify an individual’s identity. It’s also one of the simplest ways businesses implement their KYC process. With SMS-based two-factor authentication, a company sends an SMS message with a security code to an individual’s phone number. The individual then enters this code into their account to access it.

- Document Scan Authentication (DSA) is a KYC software technology that uses OCR software to scan documents and compare them with the data in the client’s profile. It can identify people, verify their identity and make sure they are who they say they are.

- QR Code Scan is a type of barcode that has become popular in recent years. They are used primarily for storing URLs, contact information, and other data that can be scanned with a smartphone or tablet. With QR code scanning, you can easily collect customer data and verify their identity without manually inputting any information or creating an account.

- Database Authentication is a type of two-factor authentication that uses data from your database to authenticate the user. This means that before you let someone into your system, they need to enter their username and password, and then they need to provide a code from your database. They send the code to them through SMS or email. The code can only be used once and expires after a certain period.

- AI Technology is being used in KYC to detect fraud more efficiently and accurately than humans can. AI can identify patterns humans cannot see, making them a more reliable for businesses. Organizations are now using AI to automate the process to reduce the time spent on KYC. The results? A reduction of over 80% in human hours while maintaining accuracy levels that exceed what humans are capable of.

Technology Can Save Your Bottom Line

The Know Your Customer process is a critical step for any business that deals with customer data. It helps ensure compliance with regulatory requirements, reduces fraud, and protects customers from identity theft. It is also an excellent way for companies to save money on hiring, training, and keeping employees and helps them identify potential risks of doing business with new clients. You can use KYC technology to benefit your business in many ways. For example, KYC may help you avoid fines and penalties by complying with regulations and laws. It may also help you save money by preventing fraud or other costly mistakes. This will increase your bottom line and make you more competitive in your industry.